Irs Income Limit 2025 - The internal revenue service recently released updated income tax brackets, standard deduction, and retirement contribution limits for the 2025. The income levels for seven tax brackets will be lowered, raising tax liabilities for millions of people.

The internal revenue service recently released updated income tax brackets, standard deduction, and retirement contribution limits for the 2025.

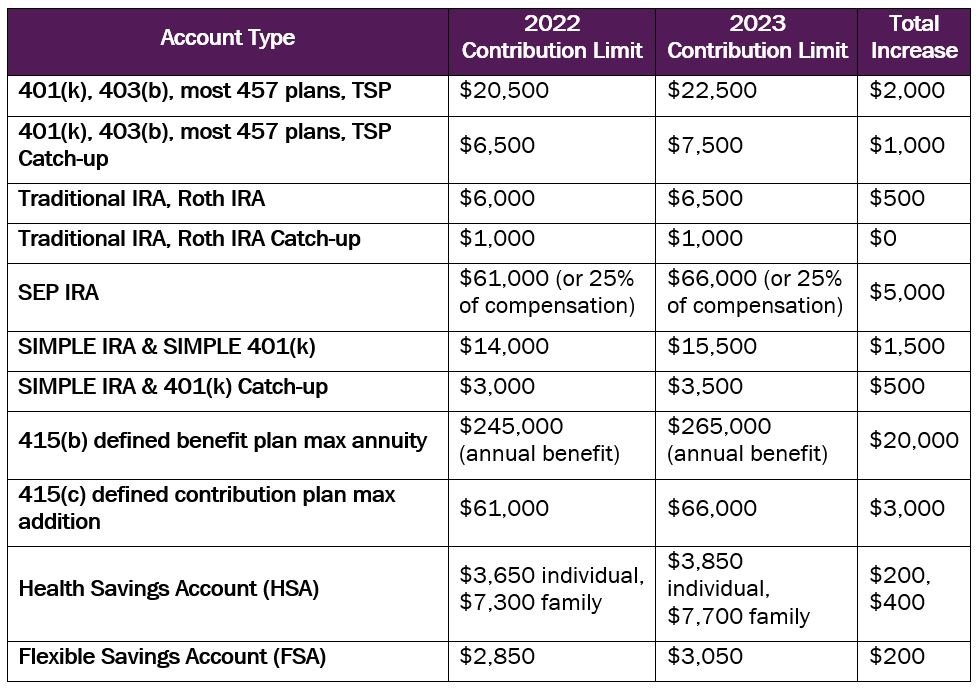

IRA Contribution Limits in 2023 Meld Financial, If your magi is higher than the income limits, the amount of child tax credit you receive will decrease by $50. The highest earners fall into the 37%.

Irs Income Limit 2025. The internal revenue service recently released updated income tax brackets, standard deduction, and retirement contribution limits for the 2025. The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, If your magi is higher than the income limits, the amount of child tax credit you receive will decrease by $50. There are seven federal tax brackets for tax year 2025.

IRS Unveils Increased 2025 IRA Contribution Limits, This figure is up from the 2023 limit of. The roth ira income limits for 2023 are less than $153,000 for single tax filers, and less than $228,000 for married and filing jointly.

IRS Announces 2023 HSA Limits Blog Benefits, If your magi is higher than the income limits, the amount of child tax credit you receive will decrease by $50. There are seven federal tax brackets for tax year 2025.

IRS Announces 2025 Limits for HSAs and HDHPs, Go to the irs website for more information. For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.

The internal revenue service's free tax filing service, direct file, is now available in 12 states for taxpayers with simple tax returns.

10%, 12%, 22%, 24%, 32%, 35%, and 37%. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and.

The IRS just announced the 2025 401(k) and IRA contribution limits, For 2025, this limitation is increased to $53,000, up from $50,000. The tax brackets and income phaseouts will be updated in irs publication 17, your federal income tax, and irs publication 970, tax benefits.

What is a Roth IRA? The Fancy Accountant, Filing status modified adjusted gross income (magi) contribution limit; The total contribution limit if you are 50 or older is $19,500 for 2025.